How To Get Repo Contracts

Yves here. Repo is a critically important mechanism past which major dealer banks finance themselves, and repo is therefore often a major topic in bank reform discussions. Nosotros thus thought it would be useful to post this overview.

By Daniela Gabor, an associate professor in the Kinesthesia of Business and Law at the Academy of Western England-Bristol and Cornel Ba, an banana professor of International Relations and Co-Managing director of the Global Economic Governance Initiative at Boston University. This is an excerpt from a recent paper that was originally published in the Journal of Common Market Studies

The 'repurchase understanding' (frequently referred to as 'repo') has get a key fiscal device for contemporary capitalism. Though the legal and formal definitions of a repo transaction can make it sound quite circuitous, information technology most merely can exist thought of as a (usually brusk-term) secured loan. In a repo transaction ane establishment (the lender) agrees to buy an asset from some other institution (the borrower) and sell the asset back to the borrower at a pre-agreed toll on a pre-agreed future date (a twenty-four hours, a week or more). The lender takes a fee (repo interest rate payment) for 'ownership' the asset in question and can sell the nugget in the case that the borrower does not live upward to the promise to repurchase it. The fundamental purpose of this circular transaction is to lend and borrow funds (and, in some cases, securities). While fiscal institutions use it to raise finance, key banks utilise it in monetary policy.

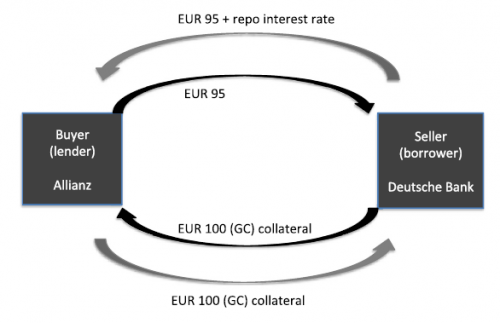

To illustrate, suppose Deutsche Bank (DB), interim as a borrower, sells avails to a buyer (Allianz), interim as a lender, and commits to repurchasing those assets later (run into Figure 1). Allianz becomes the temporary possessor of the assets, which also serve as collateral, and Deutsche Bank has temporary access to greenbacks funding. DB and Allianz also agree that the purchase toll is less than the marketplace value of collateral (€100) – in this case a 5 per cent divergence, known every bit a haircut. This provides a buffer against market fluctuations and incentivizes borrowers to attach to their promise to buy securities back. In our example, DB provides €100 worth of collateral to 'insure' a loan of €95. When the repurchase takes place, DB pays €95 plus a 'fee' or interest payment in exchange for the avails it had sold.

Figure 1: How Full general Collateral Repos Work

For DB, the repo is an SFT (securities financing transaction). DB uses its portfolio of marketable securities to raise brusque-term market funding without giving up the returns on those avails. Because repos are structured legally as sales/repurchase (of collateral) agreements and in economic terms as greenbacks loans,1 Allianz does not assume the risks and returns on the avails it owns temporarily, but rather has to send all returns on those assets to DB. Financial institutions similar to utilize repos to raise finance because the use of collateral makes them at in one case less costly and less risky than borrowing from unsecured money markets.

The presence of collateral too enables cash-rich non-bank institutions such as insurance companies, pension funds and not-financial corporations to participate in money markets (Pozsar, 2022). In our case, Allianz can use the repo to increase returns on its cash; further, information technology can too reuse the collateral ('repo it out') if information technology needs greenbacks before the repurchase with DB is executed.

It should be noted that there are different kinds of repo agreements and the kind we have just described is known as a GC ('Full general Collateral') repo. This is a funding-driven repo. What makes GC repos distinctive is that the parties to the repo transaction agree what kind of securities tin be considered equivalent as collateral and accept whatsoever or all those securities. In other words, any security that belongs to a certain agreed-upon category will do. We visualize this in Figure 1: assuming the agreed-upon GC basket above includes AA-rated Belgian and AAA German bonds, Allianz would accept €100 of High german bonds, or €100 of Belgian bonds, or any combination of the ii. A typical repo contract would allow DB to replace some or all of the bonds in the GC portfolio on any day of the repo contract, as long equally they are of equivalent value, as determined past the and so-chosen 'mark-to-market' technique, which requires that the value of collateral portfolio be constantly updated according to market place fluctuations.

Using marking-to-market place is meant to protect lenders like Allianz from the failure of counterparties like DB. In event, through the repo contract Allianz becomes the legal possessor of collateral and then that it can sell the collateral and recover the cash. For this organization to work without disruption, Allianz needs to ensure that the market place value of its collateral portfolio remains equal to the cash loan. This typically leads to a preference for loftier-quality collateral, such as investment-class authorities bonds. These merchandise in liquid markets and generally experience less toll volatility, therefore making the repo funding cheaper. Indeed, before the global fiscal crisis, market haircuts on authorities collateral were typically zero (see CGFS, 2010). Additionally, repos collateralized with government bonds also enjoy preferential regulatory majuscule treatment (ECB, 2002a). In the event that the market value of the collateral falls before the twenty-four hours of the repurchase, the legal correct to make a margin phone call protects Allianz. In other words, Allianz requires DB to provide more than collateral to brand upwards for the shortfall in value. Conversely, if collateral increases in price, Allianz returns the difference back to DB, assuasive it to raise further funding and increase leverage (Adrian and Shin, 2010).

Repo transactions have likewise altered the policy toolbox of gimmicky cardinal banks. Repos have overtaken the traditional outright auction and purchase of assets as monetary policy instruments (see ECB, 2022b). Central banks use repos to see banks' demand for reserves and thus influence interest rates on unsecured inter-bank coin markets where they implement monetary policy. Of critical importance, the central depository financial institution's collateral framework – the terms on which it lends to banks, including the potential use of haircuts, collateral acceptability and margining practices – is not exogenous to how repo markets work. Indeed, the following sections show that it can have systemic, if poorly understood, furnishings on how repo markets treat and manage collateral, on liquidity in collateral markets and on banks' ability to preserve access to (repo) market place funding in crisis (Whelan, 2022; CGFS, 2022).

Source: https://www.nakedcapitalism.com/2015/10/how-repo-works.html

0 Response to "How To Get Repo Contracts"

Post a Comment